Lehman Bros., Liquidity, Austerity, COVID-19, and the Inevitable Rise of John Maynard Keynes

Veering off of our usual topics for a bit of political economy.

Since everything is a bit out of the ordinary recently, here’s a somewhat different post, diverging from our usual path. Yes it’s about the current “Corona” situation, but also about a somewhat broader perspective. Since my educational background is in such things like philosophy, sociology and even a couple of semesters of political science, I can’t help including this perspective. On the other hand, I’m clearly not a medic nor do I have any relations to that honorable profession. So I’m entirely without expertice in this field and relying on what is to be learned from public appearances of epidemiologist who speak on the matter. (In other words, anything regarding the current situation and its epidemiological perspectives is just hearsay and lacking any further foundations. Any inferences and/or conclusions drawn from this kind of awareness are not any better than the foundations on which they are built.)

Trigger Warning

I’m sorry to say, this will not be another pep talk on the subject. If you feel apprehensive about this or do not feel like in the right mood for this, better skip this post.

So what is the current situation all about and what can be done about it? From a health perspective, there are, according to epidemiologist, three scenarios:

- Herd Immunity:

Let the pandemic spread. At least about 70% of the populace will become infected until a sufficient immunity is built up to prevent further spread. This is the “burn and forget” scenario. Since the rate of infections is exponentional, this scenario will inevitably cross the threshold of what health care instutions are able to manage and will provide the highest mortality rates. Therefore, despite some early considerations in a few countries before the entire scale of the pandemic and the potential of the virus were fully understood (compare the U.K.), it is not deemed a good idea. On the contrary, it’s exactly what we are trying to avoid. - Controlled Spread:

This is what it seems to be currently about. By policies like shutdowns and social distancing, the spread rate is meant to come to a stop. Controlled relaxing of these meassures will also allow infections to spread again, but now in a controlled manner, which will hopefully keep the rate of infections in the range of what health care and intensive care units are able to manage. By the mid of 2021, about 70% of the population will have become infected. Like Angela Merkel put it once, “Everybody will get it. 70% of the people will become infected. Be prepared.” The outcome is the same as above, while spread is pushed back over a prolonged period of time. The huge difference is in the much lower expected mortality rate and in the ability of the society to cope with the consequencies. Treatments, which are discovered or developed in the meantime, may help significantly. - Duck Until Vaccines Become Available:

Like above, but keeping the “foot on the break pedal” until a viable and tested vaccine becomes available in masses. Mind that this isn’t expected before about a year from now.

Now, this isn’t to bright of an outlook. As I understand it, nobody is really thinking that the pandemic will go away by some kind of miracle, if we just manage to maintain some restrictions for another couple of weeks. Apparently, the pandemic isn’t likely to be stopped other than by a significant rate of immunization, be it gained the natural way (by surviving infection) or by vaccines. Also, compare the history of the “Spanish Flu” of 1918/19, where several areas where hit in waves, the second and third waves often hitting much more severely than the first one. Even more so, the Spanish Flu didn’t just go away and vanish miraculously. Reportedly, most of the annual waves of conventional influenza are still related to this virus. Meaning, odds are, we will be dealing with this for quite a wile.

As can be seen from the three above scenarios, much depends on the specific state of public health services. (Private health care institutions are reportedly expected for the most to stay asside and not to contribute much, when it comes to actually dealing with the fallout of an infection rate veering out of control.) It’s all about managing infection rates to stay below the critical threshold of what can be managed. And this threshold is dependent on specific circumstances.

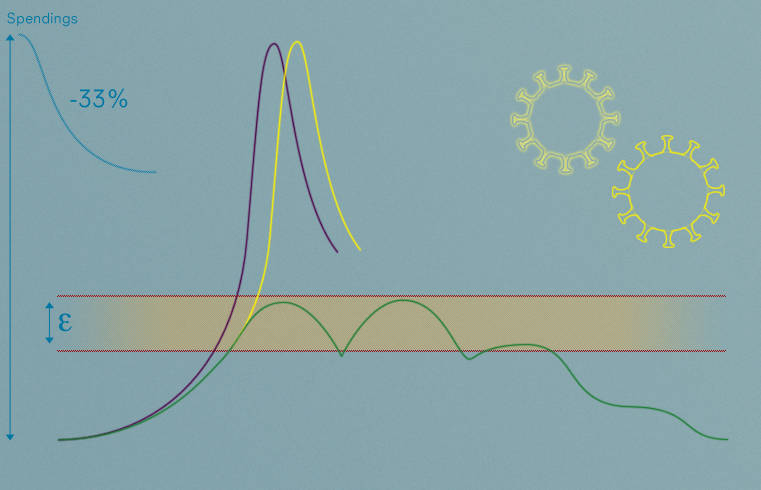

Currently, Italy and Spain are hit hardest. What these two countries have in common, is that they were also hit hard by the fallout of the Lehman Bros./subprime crisis. Soaring high on foreign investments (especially Spain was riding a real estate bubble, at the time considered a viable example for the troubled German economy — well, times, they are changing a bit, sometimes), both countries where facing a substantial loss of liquidity, while rising interest rates endangered reliquidification substantially, driven both by fears of defaults and by speculation. The outcome is well known. Thanks to help by the EU and the IMF both countries were able to recover over several years, just unitl recently. However, this help came for a price, namely austerity. The two countries were facing severe restrictions by those, who came to help. This included a substantial reduction in public spending, amongst them, expenditure in public health institutions. As a consequence, both countries had to reduce intensive care unit capacities by about a third, starting from an average rate of intensive care beds per capita for a Western European country. The same is true for medical personal, which had been reduced significally in numbers, starting with the most experienced (and also most expensive ones). Meaning, while Italy, for example, had once a well developed health care system comparable in capacity to Germany, it is now down to significantly below average. Which means, this critically lowered the threshold for what the system could cope with in the case of a crisis. Which in turn caused mortaility rates to rise in an alarming manner, as infections crossed this very threshold. It seems, there is not much of a controlled choice between options one and two, since this significantly lowered threshold doesn’t allow for political management of the crisis. (Meaning, the distance between the rising curves of the two models is too small to allow for any policies to separate them well in time to prevent one of them from crossing the specific threshold.) Facing scarce institutional resources, what’s left is triage and the usual tool kit of traditional plague management. (Hoping for the best, for what’s left of public health instutions and their increasingly overpowered personal, the true heros and heroins of this crisis.)

What this may mean for countries like Greece, already exhausted by severe restrictions imposed (“internal devaluation”) and shouldering the additional burden of overcrowded refugee camps, is nothing short of an appeal for liberal and unconditional international help. Which is also true for all the countries neighboring Syria, all of them hit by past economic crises for various reasons and now carrying the additional burden of millions of refugees, for which none of those had a chance to build up corresponding capacities in their respective public health care institutions. Again, liberal help is an imperative.

Without doubt, all economies will be affected, some less, some more severly so. As usual, funds will step in with the bill (plus interest) handed over to the tax payer. As usual, tax payers will be expected to pay twice, once by repaying the funds (with interest), once by oblieging to the fallout of austerity policies restricting public spending (without any interest for what may be left). The expectation being that, when liquidity is only established, turnover will recover in volume, the obvious gap between both meant to be bridged by interest rates artifically kept low to funnel private liquidity and/or loans into investments.

However, this will be different. Not only will economies be affected in a much broader way, not just this or that sector and others suffering from subsequent fallout, it’s about economies and volumina in turnover as a whole. And it will be about the general state of labor and employment, as well. However, austerity isn’t an option any more. Having seen how these policies have left the affected societies without the most crucial of options, namely managing the threshold, and more fallout from this still to be seen in the future, there’s no way to reduce public infrastructure as it has been the “golden way” of the past. A microeconomic perspective on macroeconomics won’t help. As night fell, the night-watchmanstate has gone to sleep, as well, resulting in a collective nightmare.

What will be needed, is an eye on economic turnover first. Not only to help economies to recover, but especially to allow for the public funding of infrastructure. Infrastructure can’t be a second or third thought anymore. As a bonus, public spendings in infrastructure may serve as a multiplier, as well. Luckily, this isn’t the first time, we’ve seen a comparable situation and there are already answers to those questions, which are still to be posed. Namely it’s a specific perspective on correlations in turnover, liquidity, labor and interest. It’s actually an answer, which had been widely accepted, regardless of the respective position in the political spectrum, in the period from after the war right into the 1970s, the exact period, the wealths of nations as we know them had been established. In other words, we’ll have to re-evalute the teachings of John Maynard Keynes. There is no way that the current spendings can be answered by austerity. As infrastructure and workers are coming closer and closer to what is known as Grenzschaden (liminal damage), there is no way to somehow magically replenish the exhausted system by austerity meassures. This time, spendings have to be followed by spendings, until the system has recovered sufficiently to provide the necessary infrastructural expenditures on its own. There is no way around this. If interest rates may affect accumulated wealths, well, be it. Because, this time, we can’t afford to protect small percentages of the accumulated wealth of few by general spending (as well as adding to this by extra interest), while waiting for the mythical trickle down effect. This isn’t going to be the Lehman crisis again. Everywhere, where this kind of medicine had been prescribed in the past, the respective system has been driven against a wall already. A wall, which may not to be argued with, because, it’s nature. Nature, which is still the grim sovereign over what is still human hubris. Nature, which has sent us a reminder of its crown.

This time, there’s no room left for a mysthicism of the will, for individualizing common consequences of what is just a distribution of percentages, maybe accompanied by a vague idea of individual fault, as it has been done in the past with unemployment (which is still a simple discrepancy in ballances of markets of goods and labor at a given state of technological development). “As it has to hit every thirtiest, let’s choose the thirtiests and it will be their fault.” — No liberalist idea of will and determination will ever overpower the risk of infection. No invisible hand will regulate and smoothen the curve, while protecting the worthy, other than by burning off a percentage of the populace in the manner of a blind wild fire, if not kept in bounds. Since, waiting for a certain percentage is all the invisible hand will do for you, with a certain amount of overshoot depending on the slope of the particular curve. And, as we may allow others to be overpowered, we will also have to burden the dire consequences which will befall us, and exponentially so. (Yes, we could still assign and attribute age and existing precoditions as individual shortcomings, but, as we are seeing it increasingly, these attributes are contributing less and less to the distribution as infrastructure fails.)

On the positive side, everything human history has ever accomplished is an ever increasing ability to overcome crisis by smoothening the curve, of skipping another vicious cycle by the accumulated arts of intervention and protective foresight. This is actually our noblest cause. Let’s concentrate on this, for a difference.

Keep calm and be well!

(Following advice of your local authorities may help. But be aware of any political consequences eventual to be drawn.)

Norbert Landsteiner,

Vienna, 2020-03-26